University expert helps bring Agatha Christie’s writing methods to life in groundbreaking new course

Associate Professor, Dr Mark Aldridge, has played a key role in bringing a new coursed based on Agatha Christie to the masses.

8 May 2025

Associate Professor, Dr Mark Aldridge, has played a key role in bringing a new coursed based on Agatha Christie to the masses.

8 May 2025

Students at Solent have made a series of films to raise awareness of community services and support wellbeing.

2 May 2025

Southampton Solent University is celebrating award-winning Mechanical Engineering students.

1 May 2025

The Institute of Biomedical Science has reaccredited Southampton Solent University for a further five years.

30 April 2025

Sports and Exercise Therapy students supported runners at the 2025 London Marathon

28 April 2025

BSc (Hons) Sport and Exercise Psychology student, Olivia Venditto is celebrating the success of a collaboration with the British Army.

28 April 2025

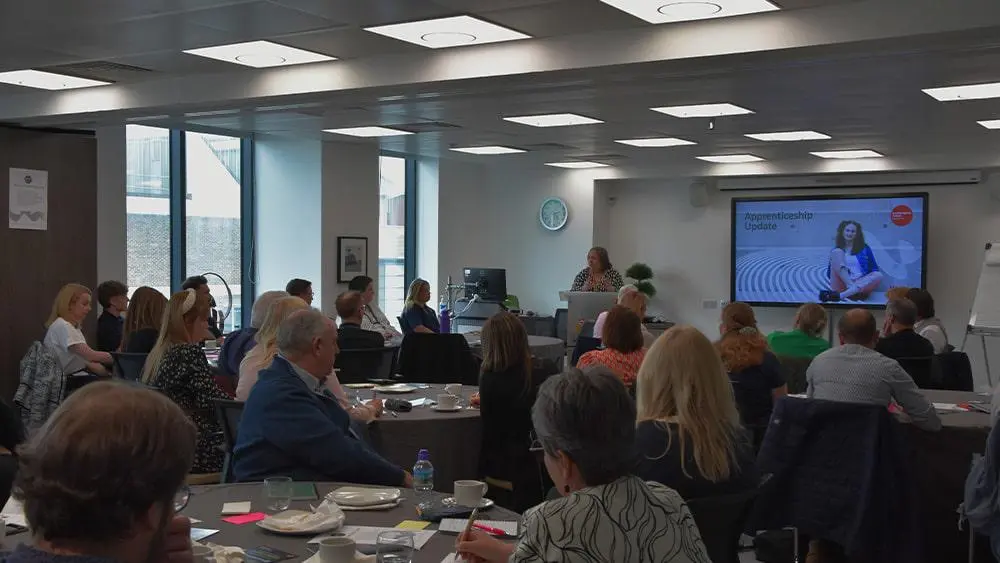

Local employers visited Southampton Solent University in April to learn more about the benefits of apprenticeships.

25 April 2025

A third-year BA (Hons) Fashion Design student will see their designs come to life following competition success.

23 April 2025

Solent continues to strengthen partnership with local football club

23 April 2025

BA (Hons) Architecture and Technology students have received prestigious awards from YMCA and CW Architects.

22 April 2025

Architectural Design and Technology students had the incredible opportunity to visit Adam Architecture, one of our industry partners.

22 April 2025

Experience life as a student at Solent at one of our on-campus or virtual undergraduate, postgraduate or maritime open days.

Find out more

Re:So has started selling handmade items by students and graduates at The Dart Centre.

16 April 2025

A talented team of BA (Hons) Television Production students successfully live-streamed the RTS Southern Awards.

15 April 2025

Southampton Solent has partnered with Union Maritime Limited to help make green travel easier

15 April 2025

The Sport at Solent Festival will be held at the end of April, featuring a number of local teams as well as Solent students

11 April 2025